Contents:

The changing role of the corporate finance department has also influenced this move. Financial analytics involves using massive amounts of financial and other relevant data to identify patterns to make predictions, such as what a customer might buy or how long an employee’s tenure might be. As a subset of business intelligence and enterprise performance management, financial analytics affects all parts of a business and is crucial in helping companies predict and plan for the future. The common-size balance sheet shows the total of assets or liabilities to be assumed as 100 and the figures are expressed as a percentage of the total.

Some organizations have also adopted zero-based budgeting, which avoids bloat and overspending by continually evaluating which expenses are necessary and which are not. The first step in the FP&A process involves collecting financial and operational data from ERP systems, data warehouses, and other business solutions. In addition, data from outside the enterprise – such as broader demographic, economic, and market data – may also be collected. Financial analysts are tasked with analyzing data from a company’s financial records.

What Is Financial Statement Analysis?

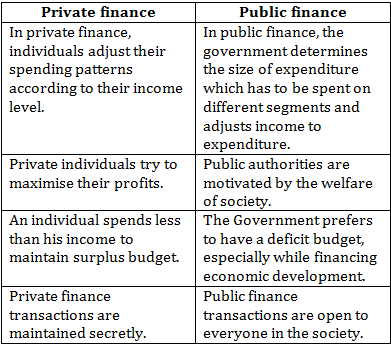

For this reason, they are constantly querying the financial analyst about the profitability, cash flows, and other financial aspects of their business. Financial analysis is the examination of financial information to reach business decisions. This analysis typically involves an examination of both historical and projected profitability, cash flows, and risk. It may result in the reallocation of resources to or from a business or a specific internal operation.

Gold Mountain Provides Operational and Corporate Update – StreetInsider.com

Gold Mountain Provides Operational and Corporate Update.

Posted: Thu, 02 Mar 2023 14:16:26 GMT [source]

With the help of financial analysis, the company can predict the company’s future, forecast future market trends, and do future planning. Discounted Payback PeriodThe discounted payback period is when the investment cash flow paybacks the initial investment, based on the time value of money. It determines the expected return from a proposed capital investment opportunity.

Fundamental Analysis

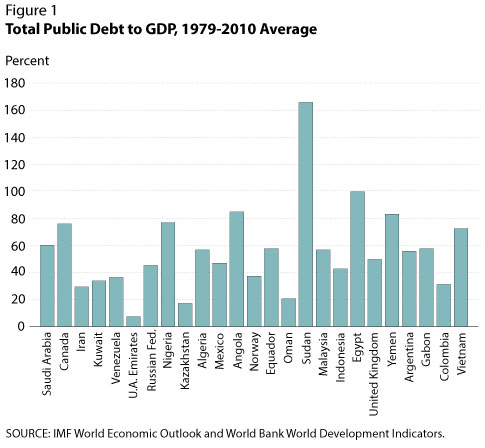

Thus, there are several familiar means to analyze financial data such as measuring ratios from financial statements and correlating these ratios to historical data of companies or other opponent corporations. Chief financial officers traditionally relied on historical data and trends to forecast future performance. However, they are changing their focus as they increasingly tap into technologies, such as advanced data analytics, machine learning and automation.

- The application of analytics is crucial in financial services and other data-intensive fields.

- However, a leader is only as good as his team; thus for financial statement analysis to be meaningful, the financial statements themselves must be accurate and the interpretations applied must be meaningful.

- Analysts may modify (“recast”) the financial statements by adjusting the underlying assumptions to aid in this computation.

- They need to find new and creative ways to make money, save money, and ensure business continuity.

- This is helpful for businesses with large receivable balances to track unpaid days of sales , which helps the company determine the amount of time it takes to convert a credit transaction into cash.

This is a measurement of how long a low-viability area will continue to function in its current state as well as the likelihood of its viability improving in time. With higher-viability areas, this attempts to forecast how well it can maintain its viability and the likelihood of its current situation changing. It is done by the Company’s finance and accounting departments and is more detailed than external analysis. Hence, the main objective of financial analysis is to make a detailed study about the cause and effect of the profitability and financial condition of the firm. Read this article to learn about the meaning, objective and types of financial analysis.

Whether corporate, investment, or technical analysis, analysts use data to explore trends, understand growth, seek areas of risk, and support decision-making. Financial analysis may include investigating financial statement changes, calculating financial ratios, or exploring operating variances. Financial ratio analysis uses the data contained in financial documents like the balance sheet and statement of cash flows to assess a business’s financial strength. These financial ratios help business owners and average investors assess profitability, solvency, efficiency, coverage, market value, and more.

For example, https://1investing.in/ investors are interested in the long-term earnings power of the organization and perhaps the sustainability and growth of dividend payments. Creditors want to ensure the interest and principal is paid on the organizations debt securities (e.g., bonds) when due. Under the financial statement analysis there is no consideration for qualitative aspects of a business.

Financial Analysis: Definition, Importance, Types, and Examples

There are two definition financial analysis of risk analysis – quantitative and qualitative risk analysis. If we are analyzing a company, we need to determine whether its debts are too high. The statement of comprehensive income includes all items that change owners’ equity except transactions with owners. Some of these items are included as part of net income, and some are reported as other comprehensive income . CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner.

Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on the statistical analysis of price movements. Technical analysis attempts to understand the market sentiment behind price trends by looking for patterns and trends rather than analyzing a security’s fundamental attributes. Technical analysis uses statistical trends gathered from trading activity, such as moving averages . Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on thestatistical analysis of price movements.

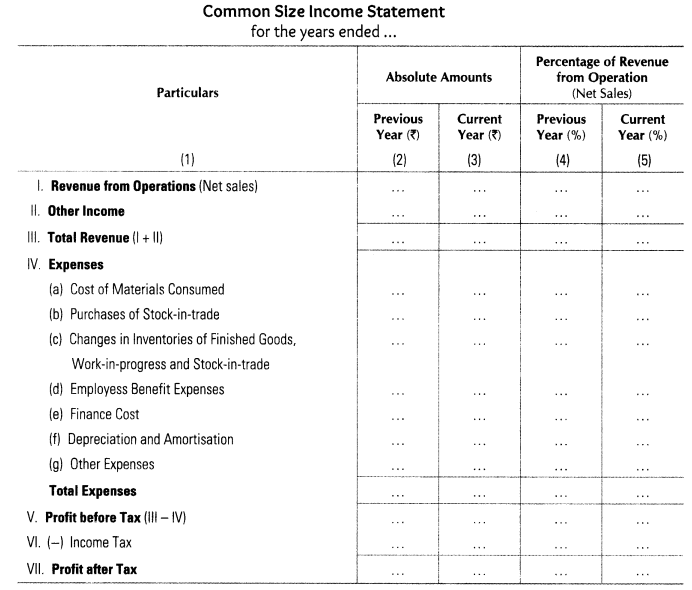

The figures of financial statements are converted into percentages with respect to a common base. The above statement shows in percentage terms the total of income earned and the expenses incurred during two or more accounting periods. As every business seeks profits, using the profitability analysis to measure its cost and revenue over a given period can be highly beneficial. Comparison, analysis, and rearrangement, and interpretation of data are the major steps involved in financial statement analysis. In investment management in choosing a portfolio one has to use financial analysis to determine “what”, “how much” and “when” to invest.

Income Tax Filing

They are one tool that makes financial analysis possible across a firm’s history, an industry, or a business sector. Financial ratio analysis assesses the performance of the firm’s financial functions of liquidity, asset management, solvency, and profitability. In this step, FP&A analysts use the prepared data to create financial forecasts that predict how the business will perform in the future and if it is headed in the right direction. Financial forecast models are also used to test out different scenarios, simulate the impact of different variables, and determine the best course of action to drive the right outcomes. However this type of analysis is not very conducive to a proper analysis of a company’s financial position, for it depends on the data for one time period. In order to make it more effective, it could be conducted both vertically as well as horizontally.

- Financial analysis is the conversion of financial data into useful information for decision making.

- Companies and analysts also use free cash flow statements and other valuation statements to analyze the value of a company.

- Such a comparative study is useful in deciding the course of action to be taken by investors and other stakeholders.

- Just like comparative analysis, the common size statement analysis is also done through an income statement and a balance sheet.

- Risk AnalysisRisk analysis refers to the process of identifying, measuring, and mitigating the uncertainties involved in a project, investment, or business.

- Financial analysis refers to an assessment of the viability, stability, and profitability of a business, sub-business or project.

A key part of this is the ability to examine historical and new data to assess what’s relevant to a specific company — be it macroeconomic data, industry trends or petroleum prices — to improve forecasting and decision-making. It is done to understand the financial position, solvency, and profitability of the business, and to make better financial decisions in future. Each of the following methods gives visibility of variances, market trends, and also flags various problems. The ultimate objectives of the review of the financial statements are analysing the company, finding rational reasons for the variances, and making adjustments based on the positive or negative trends. These ratios look at how well a company manages its assets and uses them to generate revenue and cash flow.

Mutual fund Investments

Five of the most important financial ratios for new investors include the price-to-earnings ratio, the current ratio, return on equity, the inventory turnover ratio, and the operating margin. Horizontal analysis involves evaluation of financial statements on a historical basis. For example, the progression of sales is evaluated over the years to evaluate the sales growth rate of the entity.

CMS Approves New Group Information Form under Self-Referral … – JD Supra

CMS Approves New Group Information Form under Self-Referral ….

Posted: Thu, 02 Mar 2023 23:01:59 GMT [source]

Financial services businesses, including investment banks, generate and store more data than just about any other business in any other sector, mainly because finance is a transaction-heavy industry. Basic analysis of the income statement usually involves the calculation of gross profit margin, operating profit margin, and net profit margin, which each divide profit by revenue. Profit margin helps to show where company costs are low or high at different points of the operations. This type of financial analysis involves looking at various components of the income statement and dividing them by revenue to express them as a percentage. For this exercise to be most effective, the results should be benchmarked against other companies in the same industry to see how well the company is performing.

A financial analyst will thoroughly examine a company’s financial statements—the income statement, balance sheet, and cash flow statement. Financial analysis can be conducted in both corporate finance and investment finance settings. One of the most common ways to analyze financial data is to calculate ratios from the data in the financial statements to compare against those of other companies or against the company’s own historical performance. A key area of corporate financial analysis involves extrapolating a company’s past performance, such as net earnings or profit margin, into an estimate of the company’s future performance. The primary purpose of financial reports is to provide information and data about a company’s financial position and performance, including profitability and cash flows. The balance sheet is a report of a company’s financial worth in terms of book value.

As they say in finance, cash is king, and, thus, a big emphasis is placed on a company’s ability to generate cash flow. Analysts across a wide range of finance careers spend a great deal of time looking at companies’ cash flow profiles. This process is also sometimes called a common-sized income statement, as it allows an analyst to compare companies of different sizes by evaluating their margins instead of their dollars. Financial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . MIRR In ExcelMIRR or in excel is an in-build financial function to calculate the MIRR for the cash flows supplied with a period.

Reports and data are regularly obsolete and not adjusted to key business drivers. The business analysis approach includes exercises from capacities critical to pushing the business ahead – for example, marketing, sales, and operational management – all lined up with the organization’s key vision. As opposed to focusing on only budgetary or financial valuation, the organization coordinates key useful regions that straightforwardly impact business results.

The goal of financial analysis is to analyze whether an entity is stable, solvent, liquid, or profitable enough to warrant a monetary investment. It is used to evaluate economic trends, set financial policy, build long-term plans for business activity, and identify projects or companies for investment. For example, if a firm’s debt-to-asset ratio for one time period is 50%, that doesn’t tell a useful story unless it’s compared to previous periods, especially if the debt-to-asset ratio was much lower or higher historically. In this scenario, the debt-to-asset ratio shows that 50% of the firm’s assets are financed by debt. The financial manager or an investor wouldn’t know if that is good or bad unless they compare it to the same ratio from previous company history or to the firm’s competitors. Financial ratio analysis is used to extract information from the firm’s financial statements that can’t be evaluated simply from examining those statements.

‘Financial Statement Analysis’ is a vital technique, through which the possibilities of an organization going bankrupt in future or the chances of failure of a business can be predicted. Join the most important gathering for CFOs to explore potential finance tech providers and get actionable insights for how you can prioritize technology investments. In the stock market, everything is identified with market psychology, technical analysis uses past information outlines to dissect these feelings and market changes to all the more likely comprehend patterns identified with stock. Thus, fundamental analysisis a strategy that gives you a superior conviction to recognize organizations for long haul speculation and create wealth. In a competitive job market, companies must learn how to avoid a poor candidate experience. DAM systems offer a central repository for rich media assets and enhance collaboration within marketing teams.